Heloc interest calculated daily

Theyre federally insured for up to 250000 and offer a safe place to put your money while earning interest. This is the rate at which the bank charges you interest on the loan.

How A Heloc Works Tap Your Home Equity For Cash

Upon early withdrawal all savings certificates with a 12-month.

. There may be limits to that uncertainty though like a periodic cap a limit on rate changes at one time or a lifetime cap a limit on rate changes during the. What is my tax-equivalent yield. Compound interest is a form of interest calculated using the principal amount of a deposit or loan plus previously accrued interest.

Connexus also offers home equity loans and an interest-only HELOC with an APR introductory rate starting at 357 for the first six months and 508 thereafter. At the same time the rate on a 20-year HELOC is 715 down 11 basis points. The current average HELOC interest rate.

For example a home equity line of credit can have an interest rate of prime plus one percent. Lets say you have 10000 from a lottery and want to invest that to earn more income. To calculate your daily interest on a 5-percent rate you would use this formula.

Even a small difference in the interest rate can add up to thousands over the life of the loan. The federal funds rate. Mortgages dont do that because the total amount of interest due is already calculated beforehand and can be displayed via an mortgage amortization schedule.

You can then print out the full amortization chart. Calculate Your Average Daily Balance for This Month. Override if needed Time Off Benefits.

To calculate your average daily balance for the month check your account and add up the daily balances of your. Then once you have calculated the payment click on the Printable Loan Schedule button to create a printable report. Annual Percentage Yield APY 005.

What factors affect the amount of interest you pay. Should I itemize or take the standard deduction. The repayment phase is typically 10-20 years and you cannot borrow additional funds during this time.

A HELOCs interest rate is usually variable and can change. You are eligible to enroll in the Preferred Rewards program if you have an active eligible Bank of America personal checking account and maintain a three-month combined average daily balance in your qualifying Bank of America deposit accounts andor your qualifying Merrill investment accounts of at least 20000The combined balance is calculated based on your. APY 1 rn n n 1.

Your interest rate is equal to the Prime Rate plus a margin which can be found in the terms of your Note. You can try to negotiate interest rates with your lender. Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested earning you more interest.

Average daily balance interest rate 36525 number of days in the billing cycle. Home equity loan and HELOC guide. Vacation days year 0 to 365.

Auto-calculated based on gross annual income. In this formula r is the stated annual interest rate and n is the number of compounding. Daily interest rate annual interest rate 365.

You can calculate based on daily monthly or yearly compounding. What are the tax implications of paying interest. Credit Karma is a free credit monitoring service that provides users daily VantageScore 30 credit scores based on TransUnion and weekly updates using Equifax data.

This compounding interest calculator shows how compounding can boost your savings over time. Interest Checking 0500 Balance. In other words youre only required to pay the interest charges during this time and dont have to repay any loan principle.

The mortgage interest rate. The interest rate is often tied to the prime rate and can be affected by changes in the market over the life of the HELOC. On a HELOC the interest is calculated using the following formula.

Daily Compound Interest Formula Example 2. You do not need that funds for another 20 years. The rates shown above are calculated using a loan or line amount of 30000 with a FICO score of 700 and a combined loan-to-value ratio of 80 percent.

Annual percentage yield APY is calculated by using this formula. Daily interest rate 005 365 0000137. Unlike simple interest which doesnt apply to previously.

Dividends for savings certificates are calculated daily and paid monthly. For example a 300000 mortgage set at 4 on a 30-year fixed mortgage will have total interest due of 215610 over the life of the loan. 6 to 30 characters long.

We know this beforehand because mortgages are. Daily wage Used for calculating the value of time-off benefits. You need an average daily balance of.

Amount of discount 0125 for Gold tier 0. Daily Compound Interest 61051. ASCII characters only characters found on a standard US keyboard.

Must contain at least 4 different symbols. The average daily balance can be located on your monthly billing statement. This calculator will figure a loans payment amount at various payment intervals - based on the principal amount borrowed the length of the loan and the annual interest rate.

5 Home Equity Line of Credit HELOC interest rate discounts are offered to clients who are enrolled or are eligible to enroll in Preferred Rewards based on their asset tier at the submittal of home equity application for co-borrowers at least one applicant must be enrolled or eligible to enroll. So you can see that in daily compounding the interest earned is more than annual compounding. HELOCs typically function as interest-only loans during the draw phase which is usually 5-10 years.

Imagine a 500000 mortgage with a 30-year fixed interest rate of 5. Personal Liquid Assets Accounts. Early Mortgage Payoff Examples.

As a wise man once said Money makes money. Home equity loan amounts of 25000 and up are available while HELOCs have line amounts of 10000 and up. Aside from a standard HELOC KeyBank also offers interest-only and rate-lock options.

If the lenders prime interest rate is 285 then your home equity line of credit would have an interest rate of 385 285 1. The following account rates have been declared for the month of. Once you click compute youll see how much the extra mortgage payments will save in the way of interest over the life of the loan and also how much faster youll pay off your mortgage.

The following factors will affect the amount of your interest payments.

How Is Interest Calculated On A Heloc Gobankingrates

What Is A Heloc From The Mortgage Professor

Heloc Payment Calculator With Interest Only And Pi Calculations

How A Heloc Works Tap Your Home Equity For Cash

Home Equity Calculator Free Home Equity Loan Calculator For Excel

How Is Interest Calculated On A Heloc Gobankingrates

Heloc Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

4pnhjbpk1fzjym

Calculate Daily Interest For A Heloc Youtube

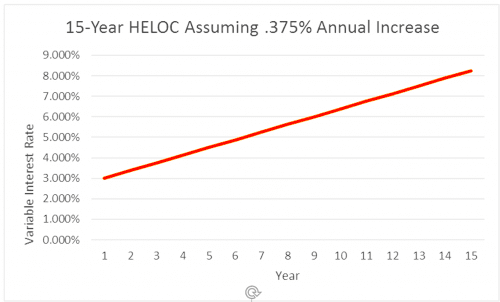

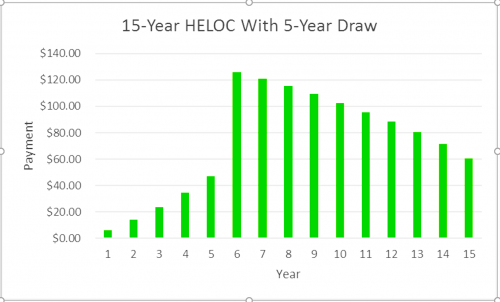

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Internet S 1 1st Lien Heloc Calculator Try Today

What You Should Know About Home Equity Lines Of Credit Heloc Canandaigua National Bank Trust

Heloc Calculator Calculate Available Home Equity Wowa Ca

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet